Let me guess — you’ve got a check in your hand and you’re wondering, “How do I deposit this into my PayPal account using my phone?” And more importantly, “How do I endorse this check properly so PayPal doesn’t reject it?”

Well, friend, you’re in the exact right place.

I’m Shahzad Ahmad Mirza, and in this practical guide, I’ll walk you through how to endorse a check for mobile deposit, PayPal, use PayPal’s Cash a Check feature, and avoid common pitfalls like denial codes, blurry images, or missing steps.

So if you’re tired of vague advice and want a real, actionable walkthrough, keep reading. This one’s for you.

Contents

- Why PayPal Mobile Check Deposit Is a Game-Changer

- What Does It Mean to Endorse a Check for PayPal?

- How to Deposit a Check Using PayPal: A Step-by-Step Guide

- What Types of Checks Can You Deposit into PayPal?

- PayPal Check Deposit Limits (What You Can and Can’t Do)

- Why Did PayPal Deny My Check? (And How to Fix It)

- How Long Does It Take for a Check to Clear on PayPal?

- What Happens After You Deposit the Check?

- What If Your Check Gets Declined? Here’s What to Do

- What to Do With Your Paper Check After Depositing on PayPal

- Common Questions (FAQs) People Ask Me All the Time

- Why I Personally Use PayPal Mobile Check Deposit

- Pro Tips to Avoid Getting Your Check Rejected by PayPal

- What Happens After the Money Hits Your PayPal Account?

- Your Final Checklist: How to Nail Every Mobile Deposit

- Who Should Use PayPal Mobile Check Deposit (And Who Shouldn’t)

- Why I Recommend PayPal Check Deposit to Everyone I Train

- Let’s Wrap It Up: Your Action Plan

- One Last Thing…

Why PayPal Mobile Check Deposit Is a Game-Changer

There’s something kind of magical about snapping a pic of a check and having the money land in your account minutes later. That’s what PayPal mobile check deposit promises.

In fact, with PayPal’s Cash a Check feature, you don’t even need a bank account anymore to handle your check-based payments. This is excellent news if you’re a freelancer, side hustler, or someone who just wants to skip that bank line.

But there’s a catch…

You need to do it exactly right. And that starts with — yes — endorsing your check correctly.

Before we go step-by-step, let’s break down the full process in plain English.

What Does It Mean to Endorse a Check for PayPal?

Endorsing a check means signing the back of it to approve its deposit into an account. But PayPal’s partner (Ingo Money) wants more than just your John Hancock.

If you don’t endorse it correctly, they’ll reject your check. And that means you’re back at square one.

Here’s what to write on the back of your check:

- Sign your name exactly as it appears on the front.

- Directly underneath your signature, write:

For Mobile Deposit Only at PayPal - Optional but recommended: Add your PayPal email address on the next line.

That’s it! But don’t write “VOID” yet — you’ll only do that after the check is approved.

And for the love of coffee, make it legible. If your handwriting looks like a doctor’s prescription note, slow down and print clearly.

How to Deposit a Check Using PayPal: A Step-by-Step Guide

This is the fun part. I’ll walk you through exactly how to upload your endorsed check to the PayPal app and get your money, without the headaches.

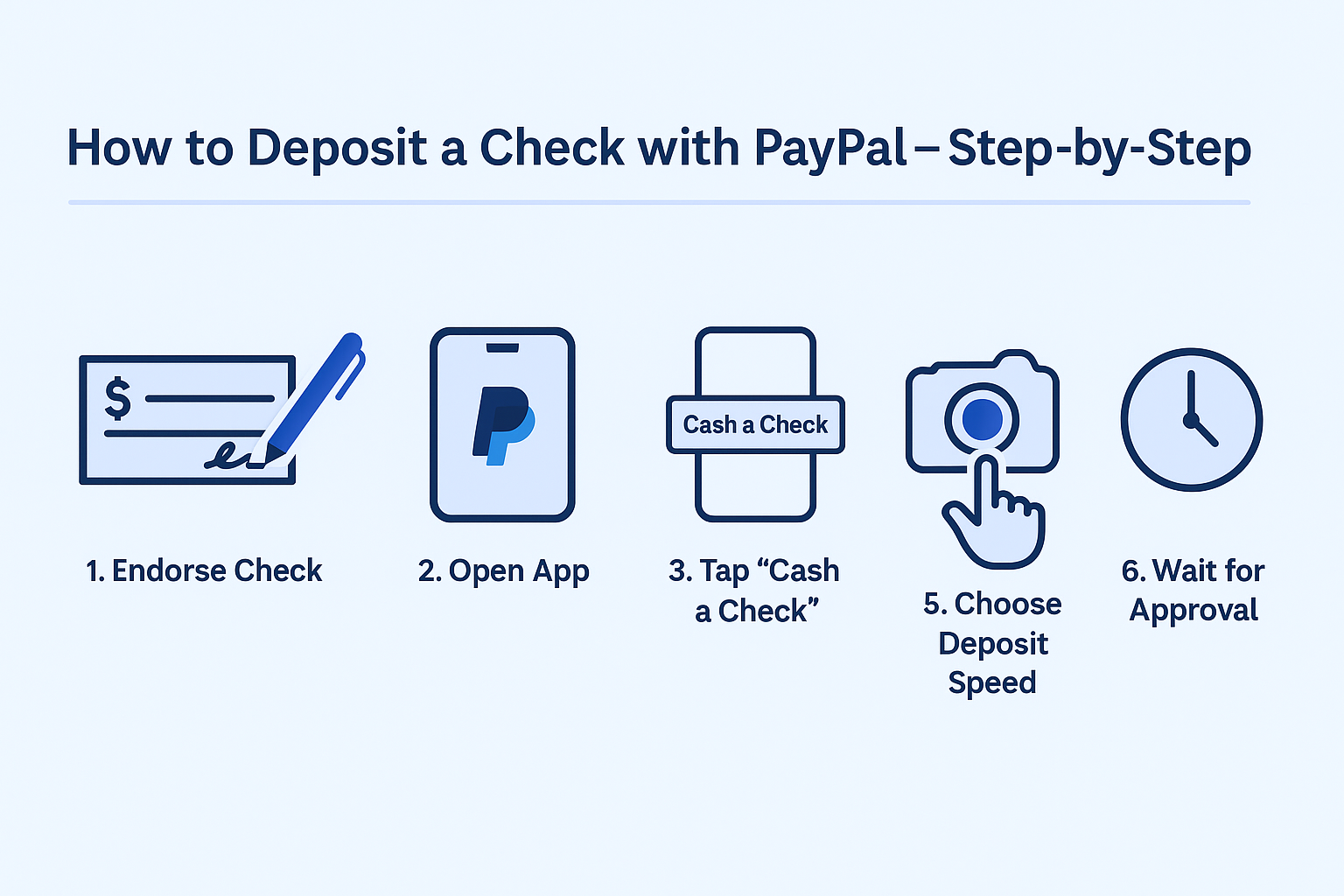

Step 1: Open the PayPal App

Sounds obvious, right? However, ensure it’s the latest version of the PayPal app for iOS or Android. Features like PayPal mobile check deposit are only available in the app (not on desktop).

Also, you need to have a PayPal Balance account (formerly “PayPal Cash”) set up. If you haven’t verified your identity yet, you’ll need to do that first.

Step 2: Tap “Cash a Check”

Once logged in:

- Go to the “Finances” or “Wallet” section.

- Tap “Cash a Check.”

If you don’t see this option, double-check that you:

- Live in the United States

- Aren’t registered in New York State (unfortunately, it’s not available there)

- Have no negative PayPal balance

Still not showing? You may need to contact PayPal support to resolve any issues that are not apparent.

Step 3: Enter the Amount on the Check

Enter the exact dollar amount as written on the check. No rounding. If it says $289.14, you enter $289.14.

This lets the system match your typed input to the scanned images later.

Step 4: Snap a Clear Photo of the Front

Here’s where most people typically make mistakes and get denied.

Place the check on a flat, dark surface with good lighting. Capture the entire front of the check within the app’s frame. Make sure:

- All four corners are visible

- Text is readable

- No shadows or blur

Step 5: Flip It and Snap the Endorsed Back

Now, photograph the back of your check, where you wrote:

Your Signature

For Mobile Deposit Only at PayPal

your-email@example.com (optional)

Make sure this endorsement is crystal clear. If not, retake the photo.

Step 6: Choose Your Deposit Speed

Now you’ll see two options:

- In Minutes (1–5% fee, funds available almost instantly)

- In 10 Days (free, but you wait 10 calendar days)

The 1% fee applies to government or payroll checks with printed signatures. Everything else is charged 5% (minimum $5).

👉 Pro Tip: Got rent due tomorrow? Go for the “In Minutes” option. Want to save cash? Wait for the 10 days.

Step 7: Wait for Approval

Once submitted, PayPal (via Ingo Money) reviews your check. Most approvals are completed in under 5 minutes.

If approved, they’ll prompt you to void the check by writing “VOID” across the front and snapping one final photo.

Boom — done!

What Types of Checks Can You Deposit into PayPal?

Unfortunately, not all checks are created equal.

Here are the accepted check types:

- Personal checks

- Payroll checks

- Government-issued checks (like tax refunds, Social Security)

- Cashier’s checks

- Insurance checks

- Business checks

All of them must be:

- In U.S. Dollars

- Drawn on a U.S. bank

- Made out to you (matching your PayPal name)

Now for the sad trombone…

PayPal does NOT accept:

- Third-party checks (signed over to you)

- Foreign checks or non-USD checks

- Money orders

- Traveler’s checks

- Temporary starter checks

PayPal Check Deposit Limits (What You Can and Can’t Do)

This part is crucial if you’re handling larger checks.

Here are the official limits:

- Per check: Typically up to $2,500

- Daily limit: $5,000

- Monthly limit: $15,000

So, no, you can’t deposit that $15,000 prize-winning sweepstakes check all at once. Break it up if possible, or use your bank instead.

Oh, and your minimum check must be at least $5. Anything below that? Sorry, PayPal won’t accept it.

Why Did PayPal Deny My Check? (And How to Fix It)

Sometimes, even when you follow all the steps, PayPal says “Nope.”

Here are common reasons your PayPal check deposit might be rejected:

- The check image was blurry or cropped

- You forgot to endorse it correctly

- The check was already deposited elsewhere

- You’re using a non-U.S. check

- Your PayPal account has restrictions or a negative balance

In some cases, you might even see Error A103, which basically means, “We’re not reviewing this check, don’t try again.” Ouch.

If this happens, you can either:

- Contact PayPal support

- Try depositing the check at your traditional bank

How Long Does It Take for a Check to Clear on PayPal?

If there’s one question I get constantly, it’s this:

“How long does PayPal take to deposit a check?”

Here’s the short version:

It depends on whether you choose an instant deposit (for a fee) or a standard deposit (free, with a wait time).

Let me break it down:

Option 1: Instant Deposit (“Money in Minutes”)

With this option, once your check is approved, the funds are deposited into your PayPal balance within minutes. You don’t need to wait for the check to clear in the traditional sense of banking.

Sounds awesome, right? It is. But here’s the fine print:

- Fee is 1% for government/payroll checks with pre-printed signatures

- Fee is 5% (minimum $5) for all other checks

- You must void the check immediately after approval

Pro Tip: This is the option I use when I’m in a crunch or if the check amount is small enough that the fee is negligible.

Option 2: Free Deposit (10-Day Wait)

If you’re not in a rush, you can choose the “Money in 10 Days” option. This means:

- No fee at all

- Funds will be added to your balance after 10 full calendar days

- You don’t need to void the check until after the funds are released

So, if you deposited the check on June 1st, expect the money by June 11th. Just make sure the check doesn’t bounce during that time — otherwise, the transaction is canceled.

And yes, weekends count. It’s calendar days, not business days.

What Happens After You Deposit the Check?

Now, you’ve endorsed your check, uploaded the pics, and chosen your deposit option. What now?

Here’s the sequence of events that typically unfolds:

- Ingo Money (PayPal’s check-processing partner) reviews your check.

- You’ll get a notification that says either:

- ✅ Approved

- ❌ Declined

- 🔄 In Review

- If approved, the funds will be added to your PayPal balance. You’ll get an email or app notification.

- You’ll be asked to write “VOID” across the check and upload a final photo of the voided check.

- After that? You’re done. You can shred the check and spend the money.

What If Your Check Gets Declined? Here’s What to Do

Yep, it happens.

Even if you did everything right, sometimes your PayPal check deposit is rejected. And that sucks.

But don’t panic — here are common causes and how to fix them:

Reason 1: Blurry or Incomplete Images

Seriously, this is the #1 reason checks get declined.

Fix it: Use better lighting, place the check on a dark background, and keep your hands steady when snapping the pic.

Reason 2: Bad Endorsement

If you didn’t write “For Mobile Deposit Only at PayPal,” or signed the wrong name, expect a rejection.

Fix it: Always endorse exactly as the check is made out, then add the mobile deposit message.

Reason 3: Duplicate Deposit Detected

If you tried to cash the check somewhere else or scanned it multiple times, Ingo’s system will flag it.

Fix it: Don’t double-dip. If one platform declines the check, wait and try another method, like a bank deposit.

Reason 4: Unsupported Check Type

Some checks just aren’t allowed — money orders, third-party checks, etc.

Fix it: Try cashing at your bank, a check-cashing store, or Walmart if they allow that type of check.

Reason 5: Error A103

This dreaded error means: “Don’t try again. You’ve been flagged.”

Fix it: Contact PayPal support and check your account for any unresolved issues. Sometimes, this is linked to prior bounced checks or security flags.

What to Do With Your Paper Check After Depositing on PayPal

Once your check is approved and you’ve been paid, PayPal asks you to VOID the check. Here’s how:

Step 1: Write “VOID” in large, clear letters across the front of the check.

Use permanent ink. Not a pencil. Not invisible ink. Don’t get creative here.

Step 2: Snap a photo of the voided check in the app.

PayPal will prompt you for this if it’s required. Just follow the steps.

Step 3: Shred or destroy the check after the voiding is accepted.

You do not want this check falling into the wrong hands. Never attempt to deposit it elsewhere once it’s been cashed — that’s fraud, my friend.

Common Questions (FAQs) People Ask Me All the Time

Can I deposit checks into PayPal business accounts?

Yes, but only if it’s a sole proprietor account and tied to your personal identity. Corporate accounts typically don’t have access to PayPal mobile deposit.

Does PayPal accept personal checks?

Absolutely. As long as the check:

- Is in USD

- Is drawn from a U.S. bank

- Is made out to you

- Isn’t third-party

You’re good.

Can I deposit checks into PayPal outside the US?

Unfortunately, no. This service is U.S.-only. Not available internationally or in New York State.

Can I use this for mobile check deposit to PayPal from someone else’s account?

Nope. The check must be payable to you. And your PayPal name must match the name on the check.

Why I Personally Use PayPal Mobile Check Deposit

Let me just say it straight:

I’ve used this feature dozens of times. When I receive a check for consulting or training, I no longer drive to the bank.

I just use PayPal mobile check deposit, especially when I’m traveling.

The speed? Killer.

The convenience? Worth every penny of that 5% fee when I need instant cash.

It’s not perfect. I’ve had one or two checks bounce or get rejected. But it’s hands-down one of the easiest ways to cash a check online, especially if you’re already in the PayPal ecosystem.

Pro Tips to Avoid Getting Your Check Rejected by PayPal

If you’ve read this far, you’re already ahead of 95% of people who try to use PayPal mobile check deposit without a clue. However, let’s refine it with some expert-level tips.

Because here’s the truth: PayPal’s check service, powered by Ingo Money, is strict. And if you mess up, you’re not just wasting time—you could get locked out from ever using it again.

Pro Tip 1: Use a Dark Background and Natural Lighting

Your camera loves contrast. Place your check on a black or dark blue surface, such as a folder or a dark desk. Avoid shadows, glare, and direct sunlight. Snap clean, crisp photos. This alone solves 80% of “declined due to poor image quality” cases.

Pro Tip 2: Don’t Overwrite the Endorsement

Only write what’s necessary:

- Your signature

- The phrase: For Mobile Deposit Only at PayPal

- Optionally: your PayPal email

That’s it. Don’t add hearts. Don’t draw arrows. Don’t overthink it.

Pro Tip 3: Match Names Exactly

Your name on the check must match your PayPal account name. If the check says “Shahzad A. Mirza” and your account says “Shahzad Mirza,” you’re probably okay. But “S. Mirza” or a completely different entity? Rejected.

Use your full legal name on PayPal for the best results.

Pro Tip 4: Avoid Redepositing a Rejected Check

If your check was already declined and marked as reviewed with something like “Do not resubmit,” don’t try again. That could flag your account.

Instead, try another service, such as your bank’s mobile app or a retailer like Walmart’s check cashing, if it fits their rules.

What Happens After the Money Hits Your PayPal Account?

Okay, so your check is approved. You’ve snapped the void photo. What now?

You’re in control.

Here’s what you can do with that money:

Use It Instantly with a PayPal Debit Card

If you’ve got the PayPal Business Debit Mastercard, you can use those funds at any store that accepts Mastercard—boom—instant access.

You can also withdraw cash at ATMs. Just be aware of the fees if you go out-of-network.

Transfer to Your Bank

Want the money in your checking account instead?

Go to:

Wallet > Transfer > Transfer to Your Bank

You can choose standard (1–3 business days, free) or instant transfer (usually a 1.75% fee, depending on your bank).

🛒 Shop Online or Pay People

You can use your PayPal balance to:

- Buy stuff online

- Send money to friends or freelancers

- Pay for software, tools, or subscriptions

In short, once that check clears, your money is real, liquid, and usable.

Your Final Checklist: How to Nail Every Mobile Deposit

Here’s the quick and dirty checklist I run through every time I deposit a check with PayPal:

✅ Is the check written to me (exactly as my PayPal account name)?

✅ Did I sign the back of the check correctly?

✅ Did I write For Mobile Deposit Only at PayPal under my signature?

✅ Did I photograph it clearly (front and back)?

✅ Did I choose the right funding speed (instant vs. 10-day)?

✅ Did I wait for approval before voiding the check?

✅ Did I shred the check after final confirmation?

If you follow that every time, your odds of rejection go way down.

Who Should Use PayPal Mobile Check Deposit (And Who Shouldn’t)

Let me be real with you.

PayPal’s mobile check deposit isn’t for everyone. However, it is a powerful tool for specific individuals.

✅ It’s perfect for:

- Freelancers or consultants are paid by check

- Small business owners (sole proprietors)

- People without traditional bank accounts

- Anyone who wants to deposit a check on the go

- People who need instant access to funds, even on a Sunday

❌ It’s not ideal for:

- Checks over $2,500

- People outside the U.S.

- Complex business entities

- Those who hate paying fees (use the 10-day free option instead)

If that sounds like you, this feature is a no-brainer.

Why I Recommend PayPal Check Deposit to Everyone I Train

I teach digital skills and entrepreneurship to people all over Pakistan and beyond. And let me tell you, access to financial tools can make or break a business.

Although PayPal mobile check deposit is currently U.S.-only, I always recommend it to my American clients, students, and partners. Why?

Because it’s:

- Fast

- Reliable

- Integrated with everything

You don’t need a bank. You don’t need to leave your house. You just need a phone, a pen, and 3 minutes.

Heck, you can cash a check in your pajamas at midnight.

That’s freedom.

Let’s Wrap It Up: Your Action Plan

Now that you know how to endorse a check for PayPal, deposit it, avoid common pitfalls, and use the funds wisely, you’re well-equipped to manage your finances effectively.

Let’s recap your next steps:

- Open the PayPal app and verify your PayPal account balance.

- Grab your check and endorse it properly.

- Take clear, well-lit photos using your phone.

- Choose your funding option—instant or 10-day.

- Void the check (only when prompted).

- Spend or transfer the funds like a boss.

One Last Thing…

Still on the fence?

Ask yourself:

“Do I want to wait in line at a bank… or do I want to get paid from my couch?”

If it’s the latter, download the app, endorse your check, and get that money in your account.

You’ve got this.

And if you ever get stuck, come back to this guide — it’s your secret weapon for mastering PayPal mobile check deposit.

Now go cash that check like a pro.

Shahzad Ahmad Mirza is a web developer, entrepreneur, and trainer based in Lahore, Pakistan. He started his career in 2000 and founded his web development agency, Designs Valley, in 2012. Mirza also runs a YouTube channel, “Learn With Shahzad Ahmad Mirza,” where he shares his web programming and internet marketing expertise. He has trained over 50,000 students, many of whom have become successful digital marketers, programmers, and freelancers. He also created the GBOB (Guest Blog Posting Business) course, which teaches individuals how to make money online.